Current: The Future of Banking

Current: The Future of Mobile Banking in 2025

As 2025 approaches, Current is emerging as the ultimate mobile banking solution for modern financial management. Available for free on both iOS and Android, Current provides a robust suite of tools designed to help you spend, save, and optimize your money more effectively than ever before.

Innovative Financial Tools

Current is more than just a mobile banking app; it’s a financial technology company that offers a holistic approach to managing your finances. Your funds are protected up to $250,000 through pass-through insurance at Choice Financial Group and Cross River Bank, both Members FDIC. This ensures your money is secure, provided certain conditions are met.

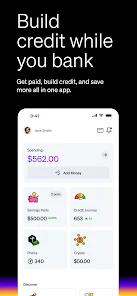

Simplified Credit Building

One of Current’s standout features is its Build Card, which allows you to build credit without the need for credit checks. This innovative feature is a game-changer for those looking to improve their credit score without the traditional hurdles.

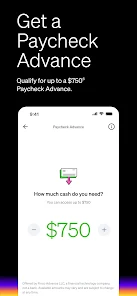

Advanced Paycheck and ATM Features

Need cash before payday? Current offers up to a $750 Paycheck Advance with no mandatory fees, making it easier to manage unexpected expenses. Additionally, you can skip ATM fees entirely by using one of the 40,000 Allpoint ATMs across the U.S., potentially saving you hundreds of dollars annually.

Faster Direct Deposits and Overdraft Protection

With Current, payday comes up to 2 days faster with direct deposit, giving you quicker access to your hard-earned money. Plus, you can access fee-free overdraft up to $200, providing a safety net for those occasional financial hiccups.

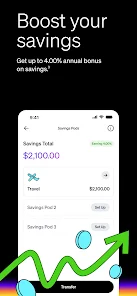

Maximize Your Savings

Current helps you grow your savings with an annual bonus of up to 4.00% on your savings. This competitive rate ensures your money works as hard as you do, helping you reach your financial goals faster.

Rewards and Unmatched Support

Earn 1x points for every dollar spent at grocery stores and restaurants, making your everyday purchases more rewarding. And if you ever need help, Current offers 24/7 support directly in the app, ensuring you're never left in the dark.

Latest Version and Future Prospects

The latest version of Current’s app is packed with features designed to enhance your financial well-being. As we look towards 2025, Current continues to innovate, ensuring its users have access to the most advanced financial tools available.

Comprehensive Terms and Conditions

For complete details on all features and terms, visit current.com/docs. Additionally, you can find more information at current.com/legal_disclaimers.

Conclusion

Current is more than just a banking app; it’s a comprehensive financial platform that offers a range of benefits designed to improve your financial health. From building credit to earning rewards, Current has something for everyone. Download the latest version today and experience the future of banking.

Additional Notes

¹ Out of network ATM fees of $2.50 per transaction may apply except at Allpoint ATMs in the U.S.² Faster access to funds is based on comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct deposit and earlier availability of funds is subject to timing of payer's submission of deposits³ The Boost rate on Savings Pods is variable and may change at any time. The disclosed rate is effective as of August 1, 2023. Must have $0.01 in Savings Pods to earn a Boost rate of either 0.25% or 4.00% annually on the portion of balances up to $2000 per Savings Pod, up to $6000 total. The remaining balance earns 0.00%. To earn a Boost rate of 4.00%, the sum of your Eligible Payroll Deposits over a rolling 35-day period must be $500 or more, with at least one Eligible Payroll Deposit equalling a minimum of $200. See Boost Terms⁴ For eligible customers only. Earn Points on Build Card purchases at retailers classified as Dining and Groceries. Points amounts and earning requirements vary at Current’s discretion. Points expire 365 days after settling. See Points Terms⁵ Actual overdraft amount may vary at Current’s sole discretion. To qualify, you must receive $500 or more in Eligible Payroll Deposits into your Current Account over the preceding 35-day period and fulfill other requirements subject to Current’s discretion. Negative balances must be repaid within 60 days of the first Eligible Transaction that caused the negative balance. See Fee-free Overdraft Terms⁶ For eligible customers only. Your actual available Paycheck Advance amount will be displayed to you in the mobile app and may change from time to time. Conditions and eligibility may vary and are subject to change at any time, at the sole discretion of Finco Advance LLC, which offers this optional feature. Finco Advance LLC is a financial technology company, not a bank. Expedited disbursement of your Paycheck Advance is an optional feature that is subject to an Instant Access Fee and may not be available to all users. Expedited disbursements may take up to an hour. See Paycheck Advance Terms

Card Issuance

The Current Visa® Debit Card, which may be issued by Choice Financial Group and/or Cross River Bank, and the Current Visa® secured charge card, which is issued by Cross River Bank, are all issued pursuant to licenses from Visa U.S.A. Inc. and may be used everywhere Visa debit or credit cards are accepted. A Current deposit account is required to apply for the Current Visa® secured charge card. Independent approval required.

Screenshots

1.INApks does not represent any developer, nor is it the developer of any App or game.

2. INApks provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. INApks abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5. If you are the owner or copyright representative and want to delete your information, please contact us support@inapks.com.

6. All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .