View pictures in App save up to 80% data.

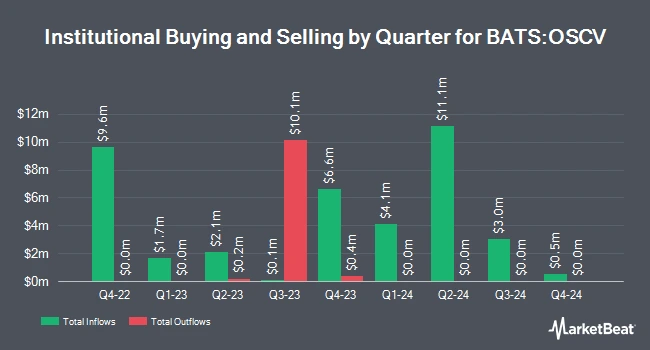

A number of other institutional investors have also recently made changes to their positions in OSCV. Park Place Capital Corp raised its stake in Opus Small Cap Value Plus ETF by 19.4% in the 3rd quarter. Park Place Capital Corp now owns 195,502 shares of the company’s stock valued at $7,322,000 after acquiring an additional 31,828 shares during the period. ORG Partners LLC boosted its position in Opus Small Cap Value Plus ETF by 3.7% during the third quarter. ORG Partners LLC now owns 200,066 shares of the company’s stock worth $7,493,000 after purchasing an additional 7,215 shares during the period. Waterloo Capital L.P. increased its stake in shares of Opus Small Cap Value Plus ETF by 3.1% in the second quarter. Waterloo Capital L.P. now owns 322,024 shares of the company’s stock worth $11,110,000 after purchasing an additional 9,808 shares in the last quarter. United Advisor Group LLC raised its position in shares of Opus Small Cap Value Plus ETF by 18.5% in the third quarter. United Advisor Group LLC now owns 150,652 shares of the company’s stock valued at $5,642,000 after purchasing an additional 23,569 shares during the period. Finally, JPMorgan Chase & Co. lifted its stake in shares of Opus Small Cap Value Plus ETF by 72.6% during the 3rd quarter. JPMorgan Chase & Co. now owns 2,756 shares of the company’s stock valued at $103,000 after buying an additional 1,159 shares in the last quarter.

Opus Small Cap Value Plus ETF Sees a 0.4% Increase in Trading

OSCV traded up $0.13 on Friday, hitting $36.81. The company’s stock had a trading volume of 88,752 shares. The stock has a market cap of $325.03 million, a price-to-earnings ratio of 16.54 and a beta of 0.87. The stock’s 50 day simple moving average is $38.89 and its 200 day simple moving average is $37.41.

Opus Small Cap Value Plus ETF Declares Dividend

The company has recently announced a dividend that was distributed on Tuesday, December 31st. Shareholders who were on record as of Monday, December 30th received a dividend of $0.1293. The ex-dividend date was also set for Monday, December 30th.

Opus Small Cap Value Plus ETF Company Overview

The Opus Small Cap Value Plus ETF (OSCV) is an exchange-traded fund primarily focused on small-cap stocks. This actively managed fund targets US small-cap companies and real estate investment trusts (REITs), selecting them based on a combination of valuation, quality, and growth indicators. The primary goal of the fund is to achieve capital appreciation. OSCV was introduced on July 18, 2018, and is managed by Opus Capital Management.

Refer to Additional Information

Want to see what other hedge funds are holding OSCV? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Opus Small Cap Value Plus ETF (BATS:OSCV – Free Report).

View pictures in App save up to 80% data.

Receive News & Ratings for Opus Small Cap Value Plus ETF Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for Opus Small Cap Value Plus ETF and related companies with MarketBeat.com's FREE daily email newsletter.