Classic Netspend

Classic Netspend App Info

Classic Netspend: Streamlined Finance for All in 2025

Editor`s review

In 2025, Classic Netspend emerges as a practical financial management app, catering to diverse users from prepaid card holders to those seeking digital banking alternatives. It offers straightforward fund management, useful budgeting tools, and secure transactions. Its intuitive interface makes it accessible for all ages, especially beneficial for those new to digital finance or without traditional bank accounts. While it provides fast fund access and cost - effective basic services, drawbacks include fees for agent - assisted transfers and reliance on payor support for early direct deposit. Overall, it's a reliable choice that balances ease of use with strong security features for modern financial management.

Why Choose this App

There are multiple compelling reasons to opt for Classic Netspend in 2025. Firstly, it's an excellent option for the unbanked or underbanked as it offers prepaid cards and deposit accounts without credit checks or minimum balance requirements. Secondly, it provides faster fund availability compared to traditional banking. When your payor supports it, you can access direct deposits sooner. Thirdly, many core features are free, such as online and mobile account - to - account transfers, with transparent fee structures for other services. Additionally, its robust security measures, including fraud prevention and real - time transaction alerts, ensure peace of mind. Finally, its user - friendly design makes it suitable for everyone, from teenagers managing their allowance to seniors handling retirement finances.

Key Features

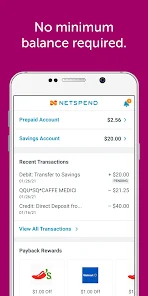

Classic Netspend comes with a range of valuable features. It integrates prepaid cards like the Netspend Visa Prepaid Card and Prepaid Mastercard, which are accepted wherever debit cards are used, and FDIC - insured deposit accounts. The All - Access Account offers functions similar to a checking account, including direct deposit, bill pay, and mobile check deposit.

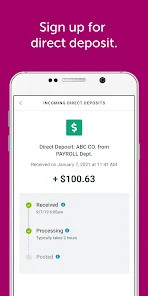

It enables faster funding, allowing early access to direct deposits when supported by payors, getting money into your account quicker than conventional banking methods.

Transaction costs are reasonable, with free online and mobile transfers between Netspend cardholders. Only agent - assisted transfers incur a $4.95 fee.

Security is prioritized with real - time fraud monitoring, customizable alerts, and two - factor authentication to safeguard your data.

Budgeting tools help you track spending, set savings goals, and review transaction histories easily.

Available on both Android and iOS, the app lets you manage accounts on - the - go, with features like mobile check deposit. It also offers 24/7 customer support via live chat, phone, and an extensive help center.

Pros & Cons

Pros:

No credit check for account opening, making it accessible to those with limited financial history.

Many free core services and clear fee structures for additional features.

Faster direct deposit availability than traditional banks when payors support it.

Strong security with fraud prevention and FDIC insurance for deposit accounts.

Available on Android (Google Play), iOS (App Store), and via a web portal.

Cons:

Agent - assisted transfers cost $4.95, and out - of - network ATM withdrawals can incur fees up to $2.50 plus operator fees.

Early fund availability depends on payors supporting direct deposit, which isn't universal.

Lacks advanced features like investment or loan services, focusing mainly on basic banking and prepaid card functions.

While Netspend doesn't charge for alerts, your wireless carrier may charge for messages or data.

How to install this app

For Android:

Open the Google Play Store on your device.

Search for "Classic Netspend".

Tap "Install" and wait for the app to download.

Open the app and create an account or sign in if you already have Netspend credentials.

Follow the in - app steps to link your prepaid card or All - Access Account.

For iOS:

Open the App Store on your iPhone or iPad.

Search for "Classic Netspend".

Tap "Get" to install the app.

Launch the app and set up your account, linking your card or account details.

Start managing your finances through the mobile dashboard.

The app requires Android 6.0+ or iOS 12.0+ and a stable internet connection.

Tips & Tricks

To maximize your use of Classic Netspend:

Use online or mobile transfers to avoid the $4.95 fee for agent - assisted transfers.

Sign up for direct deposit with your employer or benefits provider for faster funding.

Read the Cardholder Agreement or Account Terms carefully to understand potential fees for reloads, ATMs, etc.

Enable real - time transaction alerts in the app or via text to monitor account activity and prevent fraud.

Utilize the app’s budgeting tools to set spending limits and save money.

Keep your mobile number and email updated in the app to receive important notifications.

Use the app’s ATM locator to find in - network ATMs and avoid extra withdrawal fees.

Classic Netspend

Version 6.8.2Updated Oct 29, 2024

Related Articles

Review Essay: DHgate Wholesale Stores App Usage Guide Introduction

I Am Security: The VR Survival Sensation Taking Over Twitch and Reddit – Gameplay, Tips, and Why It’s a Must-Play

How to Build the Perfect Township in 2025

Best Free Skins for Roblox Clothing: 2025 Game Mods Collection

Celebrate Independence Day with These 8 Must-Have Apps

How to Redeem Robux Gift Card Codes: Step-by-Step Tutorial

Recommended Apps

All mobile Secret Codes

Libaries & Demo

Nordstrom

Shopping

Wavve Boating: Marine Boat GPS

Maps&Navigation

CARFAX Car Care App

Vehicles

PicCollage: Magic Photo Editor

Photography

Tether: Local Match Dating

Social

Screen Mirroring - Miracast

Tools

Afterpay: Pay over time

Shopping

HD Camera for Android

Beauty

JustWatch - Streaming Guide

Entertainment

Popular Apk

Be Closer: Family location

Parenting

eRomance-Romance

Books & Reference

Xbox Family Settings

Lifestyle

Yahoo Mail

Communication

Messages

Communication

ESPN Fantasy Sports

Sports

MySafeRide - Manage your rides

Medical

Albertsons Deals & Delivery

Shopping

Revolut: Spend, Save, Trade

Finance

Tzofar - Red Alert | צופר

News & Magazines