View pictures in App save up to 80% data.

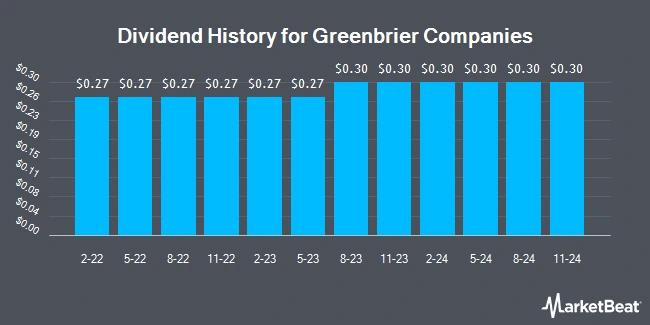

The Greenbrier Companies, Inc. (NYSE:GBX - Get Free Report) declared a quarterly dividend on Friday, January 10th,Wall Street Journal reports. Stockholders of record on Wednesday, January 29th will be given a dividend of 0.30 per share by the transportation company on Wednesday, February 19th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 1.91%. The ex-dividend date of this dividend is Wednesday, January 29th.

Greenbrier Companies has increased its dividend at an average rate of 3.6% annually over the past three years. The company's payout ratio stands at 22.7%, suggesting that its earnings adequately support its dividend payments. Analysts predict that Greenbrier Companies will generate earnings of $5.55 per share in the upcoming year, indicating that the firm should be able to maintain its $1.20 annual dividend, with an anticipated future payout ratio of 21.6%.

Greenbrier Companies Shares Rise by 3.8%

Shares of NYSE GBX traded up $2.28 during trading on Friday, reaching $62.72. 630,951 shares of the stock were exchanged, compared to its average volume of 429,602. The business's 50-day moving average price is $64.59 and its 200 day moving average price is $54.57. Greenbrier Companies has a twelve month low of $41.40 and a twelve month high of $69.12. The company has a quick ratio of 0.87, a current ratio of 1.58 and a debt-to-equity ratio of 0.91. The company has a market capitalization of $1.97 billion, a price-to-earnings ratio of 12.62, a price-to-earnings-growth ratio of 1.96 and a beta of 1.54.

Greenbrier Companies (NYSE:GBX - Get Free Report) last posted its quarterly earnings results on Wednesday, January 8th. The transportation company reported $1.72 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.16 by $0.56. The firm had revenue of $875.90 million for the quarter, compared to analysts' expectations of $849.51 million. Greenbrier Companies had a net margin of 4.52% and a return on equity of 10.86%. The firm's quarterly revenue was up 8.3% on a year-over-year basis. During the same period in the prior year, the company posted $0.96 earnings per share. As a group, equities analysts forecast that Greenbrier Companies will post 5.2 EPS for the current fiscal year.

Insider Transactions at Greenbrier Companies

In other news, SVP Ricardo Galvan sold 1,388 shares of the firm's stock in a transaction on Monday, October 28th. The stock was sold at an average price of $62.00, for a total value of $86,056.00. Following the transaction, the senior vice president now directly owns 32,388 shares in the company, valued at $2,008,056. This trade represents a 4.11 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, COO William J. Krueger sold 2,389 shares of the firm's stock in a transaction on Monday, October 28th. The stock was sold at an average price of $62.94, for a total value of $150,363.66. Following the completion of the transaction, the chief operating officer now owns 50,714 shares in the company, valued at $3,191,939.16. This represents a 4.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 12,703 shares of company stock valued at $790,338 in the last three months. Corporate insiders own 1.78% of the company's stock.

Insights from Wall Street Analysts

Multiple brokerages have recently provided updates regarding GBX. On Monday, October 21st, Susquehanna raised its price target for Greenbrier Companies from $63.00 to $65.00, assigning the company a "positive" rating. Meanwhile, Bank of America increased its target price from $60.00 to $62.00 but assigned an "underperform" rating in its research published on Thursday. Currently, two investment analysts have given the stock a sell rating, while three others have recommended a buy. Data from MarketBeat indicates that the stock holds a consensus rating of "Hold" with a price target consensus of $63.00.

Greenbrier Companies Overview

( Get Free Report )The Greenbrier Companies, Inc designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America. It operates through three segments: Manufacturing; Maintenance Services; and Leasing & Management Services. The Manufacturing segment offers covered hopper cars, gondolas, open top hoppers, boxcars, center partition cars, tank cars, sustainable conversions, double-stack railcars, auto-max ii, multi-max, and multi-max plus products, intermodal cars, automobile transport, coil steel and metals, flat cars, sliding wall cars, pressurized tank cars, and non-pressurized tank cars.

Refer to Additional Information

View pictures in App save up to 80% data.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you make any decisions about Greenbrier Companies, you should definitely listen to this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Greenbrier Companies wasn't on the list.

Although Greenbrier Companies holds a "Moderate Buy" rating from analysts, leading experts suggest that these five stocks present more attractive investment opportunities.

Market declines often make investors hesitant, and understandably so. Curious about how to mitigate this risk? Follow the link below to discover how beta can help safeguard your investments.

Download Your Complimentary ReportIf you enjoyed this article, feel free to pass it along to a coworker!